Effective asset assessment is crucial during wholesale commercial liquidation, especially in the context of mergers and acquisitions or business dissolution. A solid strategy allows businesses to understand the true value of their assets, ultimately enhancing cash flow and ensuring a smoother transition during liquidation. By exploring various methods for evaluating assets, you can maximize returns and prepare for the next steps in your business journey. Keep reading to discover effective techniques and insights that will help you navigate this critical process.

Understanding Asset Valuation in Liquidation

Understanding asset valuation during wholesale commercial liquidation is crucial for effectively managing business assets, especially in a retail context. You need to identify the different types of assets your business possesses, ranging from inventory and equipment to intellectual property and real estate. Selecting the right valuation method for each asset type is vital in ensuring accurate pricing. Keep in mind that market conditions can significantly influence asset value, so staying informed about current trends is essential. Utilizing historical data allows you to benchmark pricing effectively, while also incorporating factors related to asset depreciation and appreciation. This comprehensive approach will help you maximize recovery during the liquidation process.

Identify the Different Types of Assets

To effectively assess your business’s assets during liquidation, you must first categorize them appropriately. This includes tangible assets like equipment and inventory, as well as intangible assets such as contracts and goodwill. Consider how these elements interact with your credit history and any relevant policies affecting the valuation process.

Your construction assets, including buildings and facilities, also require careful evaluation. Engage with a trustee to navigate this complex process, ensuring that all relevant factors, such as current market conditions and asset potential, are taken into account. This thorough approach ultimately leads to more accurate asset assessments and maximizes recovery.

Apply the Right Valuation Method for Each Asset

Choosing the correct valuation method is essential to accurately assess the net worth of your assets during commercial liquidation. Different approaches, such as cost, market, and income methods, help establish the fair value of each asset based on their unique characteristics and market conditions. By applying the right method, you can ensure that your assets are priced to attract buyers while considering the influences of procurement and any potential garnishment claims related to your business.

Accurate valuations not only reflect the fair value of your assets but also enable you to effectively plan for recovery efforts. Understanding how each method impacts asset perception can help you communicate their worth clearly to potential buyers. This strategic approach not only maximizes returns but also positions you favorably in negotiations, leading to a smoother liquidation process.

Consider the Market Conditions Affecting Asset Value

As a liquidator, you must be acutely aware of the market conditions that can influence property values. Factors such as economic stability, local demand, and industry performance all play critical roles in determining how your assets are perceived. Understanding these elements can give you a clearer picture of what to expect during the liquidation process, particularly as you approach the fiscal year close and analyze your tax return implications.

In the context of debt restructuring, timely assessment of these market conditions becomes even more crucial. The value of your assets can fluctuate based on current market trends, so staying informed allows you to make strategic decisions. This knowledge not only enhances your negotiation power but also helps you position your assets effectively, leading to potentially higher returns during liquidation.

Use Historical Data for Asset Pricing Benchmarking

Utilizing historical data is a strategic way to benchmark asset pricing effectively. You should take into account inflation rates, as they affect the overall value of assets over time. By aligning your findings with your financial plan, you can ensure that your pricing reflects not only current demand but also anticipated expenses down the road.

Consultation with a lawyer can also be beneficial when analyzing historical data. They can help clarify any legal implications that may arise from asset valuations, especially during a liquidation scenario. Armed with this information, you are better positioned to make informed decisions that enhance the asset‘s market standing and increase its appeal to potential buyers.

Incorporate Asset Depreciation and Appreciation Factors

Incorporating asset depreciation and appreciation factors is essential for determining the fair market value of your assets during liquidation. By conducting thorough due diligence, you can evaluate how these factors affect your overall profit potential. Understanding the nuances of contractual obligations may also influence asset values and help you make informed decisions throughout this process.

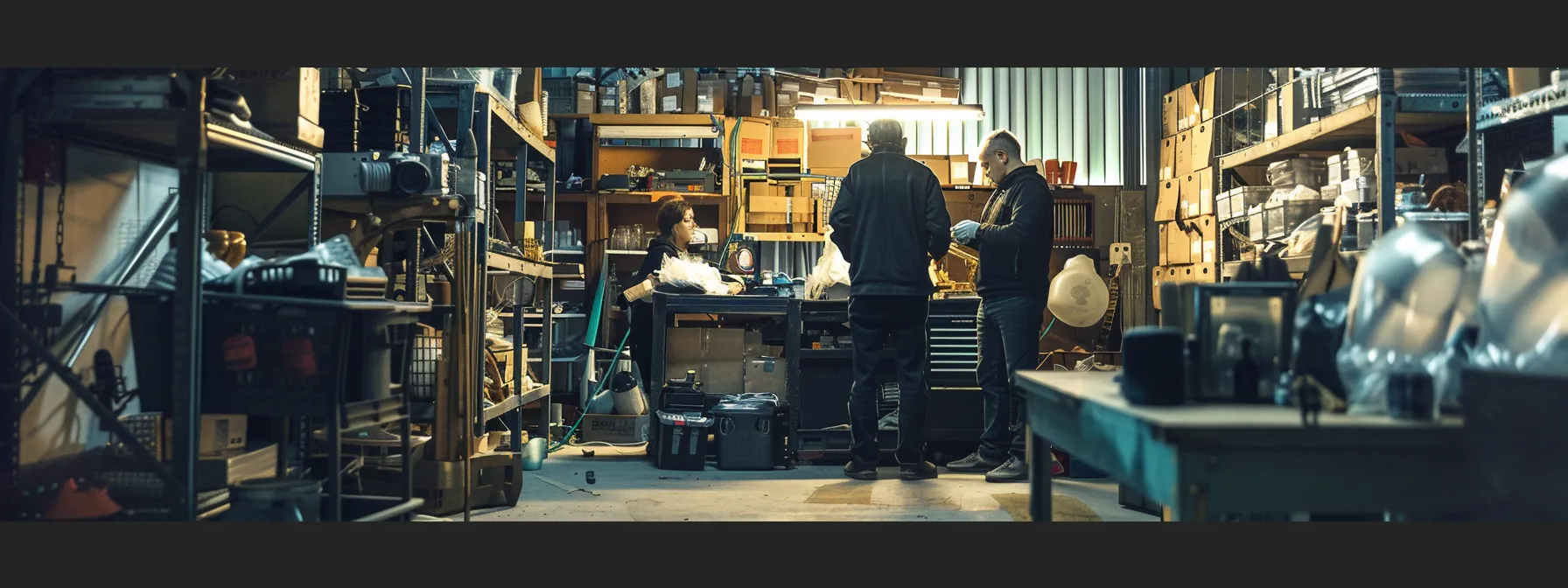

Hiring Professionals for Asset Evaluation

Hiring professionals for asset evaluation is vital as it ensures an accurate and fair assessment that can significantly impact your negotiation power during liquidation. Selecting a qualified asset appraiser is essential for establishing the true worth of your assets, including collateral tied to liabilities. Understanding the role of liquidation consultants will give you insights into effective strategies and compliance with relevant laws that protect your interests. Additionally, leveraging financial advisors’ expertise can provide valuable insights into market conditions and enhance your overall approach. Moreover, conducting an external audit for asset verification safeguards against potential failure in the evaluation process, particularly in dealings with debtors. Proper assessments not only strengthen your negotiating stance but also increase stakeholders’ confidence in your liquidation efforts.

Selecting a Qualified Asset Appraiser

Selecting a qualified asset appraiser is crucial for ensuring that your assets are valued accurately and fairly during the liquidation process. Look for appraisers with a strong background in corporate finance and experience working with creditors. Their expertise can help navigate complex valuation scenarios, offering you the insights needed to make informed decisions.

An appraiser with qualifications that include relevant certifications and a good reputation can enhance your position as you negotiate with buyers and creditors. Collaborating with an accountant and an attorney during this process can further solidify your strategy by providing legal and financial advice, ensuring that all aspects of your assets and liabilities, including any bonds, are taken into account.

Understanding the Role of Liquidation Consultants

Liquidation consultants play a pivotal role in assisting you with the intricacies of asset evaluation. They offer expert guidance on managing debt and determining the best price for your assets. Their insights can help you understand how your credit score may affect potential cash offers during liquidation, ensuring you make informed decisions that enhance your recovery.

With their expertise in debt collection processes, liquidation consultants can help streamline negotiations with creditors and buyers alike. They provide valuable knowledge on market trends and valuations that can influence your asset pricing. Engaging with these professionals enables you to create a strategic plan that not only addresses your current financial situation but also positions your business for future success.

Leveraging Financial Advisors’ Expertise

Engaging financial advisors allows you to tap into their expertise in evaluating various asset types, including intellectual property, which can be crucial during a commercial liquidation. Their insights can guide you in optimizing your asset portfolio, ensuring that your equity is assessed accurately and that you understand any potential risks tied to your mortgage or other liabilities. This careful analysis can help you maximize the value of your assets and enhance your overall recovery strategy.

Financial advisors also play a vital role in conducting audits that reveal insights into the agricultural assets you may own. They provide you with valuable benchmark data and market trends that inform your decisions, allowing you to make strategic moves that position your assets effectively. Their guidance ensures you have a clear understanding of your financial landscape, leading to more informed actions throughout the liquidation process.

The Benefits of an External Audit for Asset Verification

Engaging a contractor for an external audit benefits you significantly by providing an unbiased evaluation of your assets. This process adds a layer of verification, ensuring that the valuation meets industry standards and regulatory requirements. Furthermore, the fee associated with hiring a professional can be a worthwhile investment, as their expertise may reveal potential areas for discounting, leading to a more accurate asset assessment.

An external audit is also advantageous for establishing credibility with potential buyers and creditors. The thoroughness of this evaluation reflects your commitment to transparency and compliance with relevant regulations. This level of diligence can bolster your negotiating position, allowing you to present your assets with confidence during the liquidation process.

Legal and Regulatory Considerations in Asset Assessment

In the complex landscape of commercial liquidation, understanding the legal and regulatory frameworks that govern asset assessment is imperative. You must navigate bankruptcy laws effectively, as they directly affect how your assets are valued and sold during times of insolvency. Compliance with both state and federal tax laws is crucial to avoid unnecessary penalties and ensure that your financial practices align with legal standards. Additionally, grasping the priorities of liens and secured creditors is vital, as these factors influence the order in which debts are settled and may impact your overall recovery. Environmental regulations may also come into play, especially concerning assets tied to land use or natural resources. Being aware of these dynamics can help you make informed decisions, ultimately enhancing your negotiation power and maximizing asset value through a comprehensive understanding of your obligations regarding escrow, pension liabilities, and loan guarantees, paired with an analysis of the right ratio for evaluating potential returns.

Navigating Bankruptcy Laws During Liquidation

Navigating bankruptcy laws during liquidation requires a clear understanding of the restructuring process. You need to assess your inventory accurately while ensuring that your asset valuation aligns with legal standards. By staying informed about these laws, you can strategically manage your debt relief efforts and avoid pitfalls, such as claims of fraud that can arise during asset sales.

Compliance With State and Federal Tax Laws

Ensuring compliance with state and federal tax laws is critical during asset assessment in commercial liquidation. You need to research applicable tax regulations thoroughly, as these laws affect distributions and can have significant implications on the value you assign to your assets. Additionally, understanding how liens attached to your assets can affect credit ratings will help you navigate the complex landscape of asset sales more effectively.

Tax obligations can influence how you approach the valuation of your assets, including vehicles and other tangible possessions. By staying informed about your liabilities and ensuring compliance, you’ll fortify your position during negotiations. This diligence not only enhances your overall strategy during liquidation but also mitigates potential issues that may arise from non-compliance.

Understanding Lien and Secured Creditor Priorities

Understanding the hierarchy of liens and secured creditors is vital for managing your assets effectively during liquidation. This knowledge helps you prioritize which debts should be settled first, ensuring that you can negotiate effectively with potential buyers. When determining the value of a capital asset, keep in mind how liens may impact your revenue and the down payment required from buyers.

Secured creditors often have first claim on the generated revenue from asset sales, influencing your liquidation strategy. Knowing this, you can better position your assets in the market, allowing for more informed options that enhance your overall return. As you navigate through the selling process, prioritizing these relationships can lead to more favorable terms and secure outcomes.

Environmental Regulations Affecting Asset Liquidation

When evaluating assets during the liquidation process, it’s vital to consider environmental regulations that may impact your ability to sell or lease those assets. If you are facing a default situation, understanding these regulations helps you accurately assess the value of your assets, especially if they are subject to specific environmental laws. Failing to account for these factors can significantly hinder your financial recovery and complicate your petition for debt relief.

Additionally, compliance with environmental standards is crucial, as it can determine the feasibility of future leases or sales of your assets. Evaluating compliance ensures you do not overlook potential liabilities that could emerge later, which may affect your negotiation strategy. Staying informed about these regulations strengthens your position throughout the liquidation process and can lead to more favorable outcomes.

Utilizing Technology for Efficient Asset Evaluation

Utilizing technology enhances your ability to evaluate assets effectively during commercial liquidation. Innovative software tools assist in managing and valuing inventory, ensuring that you maintain an accurate reflection of your net income while reducing financial risk. Online platforms broaden your market reach, connecting you with more potential buyers, which is crucial when aiming to maximize recovery. Implementing blockchain technology provides transparency in asset tracking, reassuring stakeholders throughout the liquidation process. Moreover, artificial intelligence can play a significant role in predicting asset valuation trends, helping business owners make informed decisions that align with judicial requirements in court. As you consider these technological advancements, be sure to fill out the request form for professional assistance tailored to your needs.

Software Tools for Inventory Management and Valuation

Software tools designed for inventory management play a crucial role in helping you assess your assets effectively during business liquidation. By tracking currency fluctuations and ownership details, these tools provide detailed insights into the value of your inventory, enabling you to make informed decisions. This capability is especially helpful for small businesses, as it streamlines the evaluation process and informs strategies for managing potential liabilities.

Leveraging technology not only simplifies asset valuation but also enhances transparency throughout the liquidation process. Accurate inventory management software allows you to understand your financial standing better, ensuring compliance with regulations set forth by the Small Business Administration. With these resources, you are empowered to reduce risks associated with outstanding liabilities and to maximize asset recovery during liquidation.

Online Platforms for Broadening the Buyers‘ Market

To broaden your buyers‘ market during commercial liquidation, leverage online platforms that allow you to showcase your estate assets more effectively. These platforms provide a direct connection to potential buyers and investors looking for unique opportunities, ensuring you can highlight the security interest tied to your assets. By expanding your reach, you can attract buyers who might not be accessible through traditional means, ultimately aiding in a more profitable liquidation process.

Utilizing online marketplaces also enhances your ability to navigate tax obligations associated with asset sales. You can present comprehensive information about your assets, including any existing surety, which can instill confidence in potential buyers. Engaging with these platforms not only increases your chances of successful sales but also helps clarify the overall value of your assets during the liquidation process.

Implementing Blockchain for Transparent Asset Tracking

Implementing blockchain technology streamlines the asset tracking process, allowing you to monitor the market value of your corporation‘s assets accurately. By creating a secure, tamper-proof record of each transaction related to your assets, you ensure that all relevant documents are easily accessible and verifiable. This transparency not only facilitates compliance with the United States Code but also enhances your credibility with potential buyers and financial institutions.

The Role of AI in Predicting Asset Valuation Trends

Artificial intelligence (AI) offers significant advantages when predicting asset valuation trends, which can enhance your exit strategy during commercial liquidation. By analyzing historical data and market conditions, AI algorithms can identify patterns that reveal potential risks associated with different asset classes. This insight allows you, as a debtor, to make informed decisions regarding the timing and pricing of your assets, ultimately maximizing recovery while navigating any customs regulations that may apply.

Utilizing AI for asset valuation helps you streamline processes tied to your employer identification number, ensuring compliance with legal obligations. The technology evaluates vast amounts of data in real-time, giving you the ability to anticipate fluctuations in asset value more accurately. As a result, you can adjust your liquidation strategy proactively, reducing uncertainty and protecting your interests throughout the liquidation process.

Asset Liquidation Strategies to Maximize Value

To maximize value during commercial liquidation, consider various asset disposal methods tailored to your specific circumstances. Opting for auctions versus private treaty sales can significantly impact how quickly and profitably you liquidate your assets. Additionally, timing the market strategically allows you to capitalize on trends, ensuring optimal conditions for asset disposal. Analyze bulk sales compared to individual asset sales to determine the most beneficial approach for your situation, while employing digital marketing techniques can enhance visibility and attract a broader audience. Keep in mind your partnerships and shareholders, as these relationships may influence your approach. Proper evaluation of your assets, including any associated life insurance or renting agreements, plays a crucial role in guiding your decisions throughout this process.

Opting for Auctions vs. Private Treaty Sales

Choosing between auctions and private treaty sales represents a critical decision for your business valuation during liquidation. Auctions can create a competitive atmosphere, driving up the price of your assets, which may help you settle outstanding debts more effectively. This method often attracts buyers eager to find bargains, potentially enhancing your recovery while minimizing the risk of foreclosure.

Conversely, private treaty sales allow for more negotiation flexibility, catering to your specific needs and timelines in managing debt settlement. This approach can foster a more personalized relationship with potential buyers, allowing transparency about asset conditions and valuations. Ultimately, your decision should reflect the urgency of your situation and the strategic goals you have for liquidating your assets.

Timing the Market for Optimal Asset Disposal

To achieve optimal asset disposal during liquidation, you must pay close attention to market conditions and interest rates. By timing your sales to coincide with periods of low interest, you can attract buyers who are cautious about their debt levels. This approach becomes even more crucial when dealing with unsecured debt, as buyers seek favorable terms and may be influenced by the overall economic climate.

Additionally, understanding your potential buyers’ interests helps you make strategic decisions on when to sell your assets. Many buyers are hesitant during times of economic uncertainty, which may lead to reduced offers or prolonged sales cycles. By assessing market trends related to crime rates and financial institutions’ stability, you can position your assets more effectively and maximize returns during the liquidation process.

Bulk Sales vs. Individual Asset Sales Analysis

When deciding between bulk sales and individual asset sales, consider how each approach impacts your overall income. Bulk sales often lead to quicker transactions, allowing you to convert assets into cash more rapidly, which is essential during liquidation. However, selling assets individually can yield higher returns for unique or high-demand items, leading to increased income over time.

Evaluating your assets’ market appeal can guide your decision in maximizing liquidation value. If certain items are more valuable on their own, individual sales may prove more profitable, significantly boosting your income during the process. Balancing these strategies enables you to develop a tailored approach that aligns with your specific financial goals and recovery strategy.

Digital Marketing Techniques for Asset Disposition

Implementing digital marketing techniques can significantly enhance your asset disposition strategy during commercial liquidation. By utilizing targeted social media campaigns and search engine optimization, you can reach potential buyers more effectively, showcasing your assets to audiences that are actively looking for opportunities. Engaging content, coupled with eye-catching visuals, can draw in interested parties and increase the likelihood of successful sales.

Additionally, leveraging email marketing allows you to maintain communication with interested buyers, providing updates on asset availability and pricing. Crafting compelling messages and clear calls to action can inspire immediate responses and drive sales. By consistently applying these digital marketing methods, you position your assets for optimal visibility, ultimately maximizing recovery and streamlining the liquidation process.

Post-Liquidation Asset Management and Final Settlement

After completing the liquidation process, managing the outcomes and responsibilities becomes essential for both you and your stakeholders. You must navigate the complex task of distributing proceeds among creditors and shareholders, ensuring that all parties receive fair compensation based on their claims. Addressing any unsold assets is another critical consideration, as these items require strategic planning to maximize value or find suitable alternatives for resolution. Additionally, you have final accounting and reporting obligations that must be met to maintain transparency and adherence to regulatory standards. This stage also presents an opportunity to reflect on the lessons learned throughout the process, enabling you to develop more effective strategies for future liquidations. By integrating these aspects into your post-liquidation management, you enhance the potential for smoother transitions and solid preparations for any subsequent challenges you may face.

Distributing Proceeds Among Creditors and Shareholders

After liquidation, you need to distribute the proceeds carefully among your creditors and shareholders. Prioritize payments based on the established hierarchy of debts, ensuring that secured creditors receive payment first, followed by unsecured creditors, while also considering any claims from shareholders.

It’s important to maintain clear communication with all parties involved during this process. Keeping your stakeholders informed about the distribution of funds fosters trust and transparency, making it easier to navigate any potential disputes that may arise regarding the allocation of proceeds.

Dealing With Unsold Assets Post-Liquidation

Once the liquidation process concludes, addressing unsold assets promptly is essential. Evaluate the remaining inventory to determine its marketability and consider alternative strategies such as charitable donations, auctioning, or outright sales at discounted prices. This proactive approach can help recoup some value while mitigating ongoing holding costs.

Engaging a professional appraisal service may further assist you in exploring creative solutions for these assets. Understanding market dynamics and current demand will enable you to make informed decisions that can optimize the remaining inventory’s final disposition. By managing unsold assets effectively, you can minimize losses and reinforce your overall financial recovery strategy.

Final Accounting and Reporting Obligations

After the liquidation process concludes, it’s essential for you to maintain meticulous records of all financial transactions. Accurately documenting each step ensures compliance with relevant laws and helps address any inquiries from stakeholders regarding the distribution of proceeds.

Additionally, you must prepare comprehensive reports that outline the financial outcomes of the liquidation. These reports not only reflect the overall performance but also provide valuable insights that can inform any future business decisions and liquidations you may face.

Lessons Learned and Strategic Planning for Future Liquidations

Reflecting on the liquidation process offers valuable insights that can enhance your future asset management strategies. You should analyze what worked well and what didn’t, adjusting your approaches accordingly to improve efficiency and outcomes in subsequent liquidations.

Effective strategic planning involves setting clear objectives based on your past experiences. By implementing lessons learned, you position yourself to navigate future challenges more adeptly, ensuring that you maximize value and minimize risk throughout the process.

Conclusion

Effective methods for assessing assets during commercial liquidation are crucial for maximizing recovery and ensuring fair pricing. Accurate valuation helps you understand the true worth of your assets, allowing for strategic decision-making in negotiations. Staying informed about market conditions and utilizing historical data enhances your ability to adjust pricing effectively. Ultimately, these practices foster transparency and confidence among stakeholders, leading to smoother transactions and better outcomes.

Share This Story, Choose Your Platform!

Get In Touch

Phone: (847) 722-6942

Email: sales@end2endlogix.com

Web: end2endlogix.com